Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Discover the Revolutionary Modeling and Valuation Techniques for Energy Structures!

Energy structures, such as power plants, wind farms, and solar installations, play a critical role in meeting the world's constantly growing energy demands. Modeling and valuation of these structures have become paramount in the pursuit of sustainable and economically viable energy sources.

The Importance of Accurate Modeling

Accurate modeling is the cornerstone of any successful energy project. It involves the creation of mathematical representations that simulate various aspects of energy structures, their interactions with the surrounding environment, and their overall performance. Models enable engineers, researchers, and investors to test different scenarios, make informed decisions, and optimize the design, operation, and profitability of energy systems.

Advanced modeling techniques allow for precise predictions of energy production, efficiency, and potential risks. By utilizing data from meteorological conditions, equipment specifications, and historical performance, analysts can identify opportunities for improvement, assess the feasibility and financial viability of projects, and provide valuable insights to stakeholders.

5 out of 5

| Language | : | English |

| File size | : | 14172 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 475 pages |

The Valuation Process

Valuation represents the quantification of the worth or value of an energy structure. It involves the assessment of factors such as market demand, regulatory frameworks, supply chain dynamics, and financial considerations. The valuation process aims to provide an accurate estimation of the asset's potential returns, risks, and overall feasibility.

Valuation models consider several parameters, including future energy prices, technological advancements, operational costs, and project lifetime. Models can incorporate different valuation methodologies, such as discounted cash flow (DCF),real options analysis, or comparable transactions analysis. The chosen approach will depend on the specific characteristics and requirements of the energy structure under evaluation.

The Role of Technology in Modeling and Valuation

Technology plays a critical role in both modeling and valuation of energy structures. The availability of advanced software, data analytics tools, and computer simulations has revolutionized the energy industry. With the help of these technologies, engineers and analysts can develop highly accurate models, perform complex calculations, and assess the financial implications of their decisions in near real-time.

The integration of machine learning algorithms, artificial intelligence, and big data analytics enables the processing of vast amounts of information and the identification of patterns and trends. These techniques enhance accuracy, reduce uncertainties, and offer valuable insights into potential risks and opportunities. As a result, modeling and valuation processes become more efficient and reliable.

The Future of Modeling and Valuation

The modeling and valuation of energy structures will continue to evolve as the energy landscape undergoes significant changes. With the increasing focus on renewable energy sources and the transition to a low-carbon economy, there is a growing need for innovative approaches and comprehensive models that cater to the specific requirements of renewable energy projects.

Emerging technologies, such as blockchain, can enhance transparency, improve data security, and streamline transaction processes within the energy sector. These advancements will have a profound impact on the modeling and valuation practices, allowing for more accurate and efficient assessment of energy structures.

Modeling and valuation of energy structures are essential for designing sustainable and economically viable energy systems. Accurate modeling, leveraging technology advancements, and employing robust valuation methodologies enable stakeholders to make informed decisions, optimize operations, and maximize returns.

As the world shifts towards renewable energy, the modeling and valuation processes will continue to evolve, incorporating new technologies and practices. By staying at the forefront of these advancements, professionals in the energy sector can ensure the successful development and deployment of energy structures that meet the world's growing energy needs.

5 out of 5

| Language | : | English |

| File size | : | 14172 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 475 pages |

Commodity markets present several challenges for quantitative modeling. These include high volatilities, small sample data sets, and physical, operational complexity. In addition, the set of traded products in commodity markets is more limited than in financial or equity markets, making value extraction through trading more difficult. These facts make it very easy for modeling efforts to run into serious problems, as many models are very sensitive to noise and hence can easily fail in practice.

Modeling and Valuation of Energy Structures is a comprehensive guide to quantitative and statistical approaches that have been successfully employed in support of trading operations, reflecting the author's 17 years of experience as a front-office 'quant'. The major theme of the book is that simpler is usually better, a message that is drawn out through the reality of incomplete markets, small samples, and informational constraints. The necessary mathematical tools for understanding these issues are thoroughly developed, with many techniques (analytical, econometric, and numerical) collected in a single volume for the first time. A particular emphasis is placed on the central role that the underlying market resolution plays in valuation. Examples are provided to illustrate that robust, approximate valuations are to be preferred to overly ambitious attempts at detailed qualitative modeling.

Howard Powell

Howard PowellUnmasking the Enigma: A Colliding World of Bartleby and...

When it comes to classic literary works,...

Jeffrey Cox

Jeffrey CoxCritical Digital Pedagogy Collection: Revolutionizing...

In today's rapidly evolving digital...

Quincy Ward

Quincy WardThe Diary Of Cruise Ship Speaker: An Unforgettable...

Embark on an incredible...

Derek Bell

Derek BellBest Rail Trails Illinois: Discover the Perfect Trails...

If you're an outdoor enthusiast looking...

Adrian Ward

Adrian WardChild Exploitation: A Historical Overview And Present...

Child exploitation is a...

Camden Mitchell

Camden MitchellThe Untold Story Of The 1909 Expedition To Find The...

Deep within the realms of legends and...

Spencer Powell

Spencer PowellThrough The Looking Glass - A Wonderland Adventure

Lewis Carroll,...

Sidney Cox

Sidney CoxAdvances In Food Producing Systems For Arid And Semiarid...

In the face of global warming and the...

Art Mitchell

Art MitchellThe Devil Chaplain: Exploring the Intriguing Duality of...

When it comes to the relationship between...

Edgar Hayes

Edgar HayesThe Mists of Time: Cassie and Mekore - Unraveling the...

Have you ever wondered what lies beyond...

John Steinbeck

John SteinbeckOn Trend: The Business of Forecasting The Future

Do you ever wonder what the future holds?...

Tim Reed

Tim ReedLove Hate Hotels Late Check Out

Have you ever experienced the joy of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Christian BarnesIf Boys Could Hold Hands: Breaking Down Gender Stereotypes and Celebrating...

Christian BarnesIf Boys Could Hold Hands: Breaking Down Gender Stereotypes and Celebrating...

J.R.R. TolkienThe Ultimate Costa Brava Food Guide: Unveiling the Gastronomic Delights of...

J.R.R. TolkienThe Ultimate Costa Brava Food Guide: Unveiling the Gastronomic Delights of...

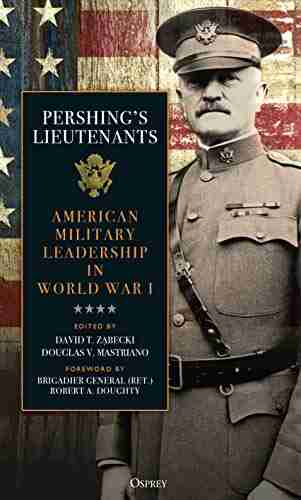

Russell MitchellAmerican Military Leadership In World War: The Unparalleled Strategy and...

Russell MitchellAmerican Military Leadership In World War: The Unparalleled Strategy and... Austin FordFollow ·6.7k

Austin FordFollow ·6.7k Greg FosterFollow ·8.6k

Greg FosterFollow ·8.6k Brayden ReedFollow ·4.9k

Brayden ReedFollow ·4.9k Will WardFollow ·13.5k

Will WardFollow ·13.5k Ira CoxFollow ·11k

Ira CoxFollow ·11k Rod WardFollow ·11k

Rod WardFollow ·11k Ben HayesFollow ·16k

Ben HayesFollow ·16k Oliver FosterFollow ·8.4k

Oliver FosterFollow ·8.4k