Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

The Ultimate Guide to Buying and Selling Private Companies and Businesses

Are you considering buying or selling a private company or business? Whether you are an entrepreneur looking to acquire a successful business or a business owner wanting to sell and move onto new ventures, understanding the process of buying and selling private companies is crucial for a successful transaction. In this guide, we will take you through the step-by-step process, explore key considerations, and provide valuable tips to help you navigate the complex world of buying and selling private companies and businesses.

Understanding the Market

The first and most important step in buying and selling private companies is to understand the market and industry trends. Conduct thorough research to identify the sectors that are growing, experiencing high demand, and have the potential for future profitability. Consider factors such as market competition, consumer behavior, and regulatory changes that might impact the industry.

When selling a private company, determine its market value by conducting a business valuation. Seek professional assistance from appraisers or financial advisors who can assess the assets, liabilities, market conditions, and growth potential to provide an accurate valuation. This will allow you to set a realistic and attractive selling price.

4.6 out of 5

| Language | : | English |

| File size | : | 2588 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 731 pages |

| Screen Reader | : | Supported |

Prepare for the Sale

Prior to putting your private company on the market, it is essential to prepare all necessary documentation related to finances, legalities, and business operations. This includes financial statements, tax records, legal contracts, employee agreements, and any other relevant paperwork. Ensuring that these documents are readily available will expedite the due diligence process and build trust with potential buyers.

Additionally, consider enhancing the company's overall look and appeal. Invest in marketing materials, update your website, and highlight the unique selling points and potential growth opportunities of your business. A well-presented and professional image can greatly increase the chances of attracting serious buyers.

Finding the Right Buyer or Seller

Whether you are buying or selling, finding the right match is crucial for a successful transaction. Utilize various channels for marketing your business, such as online business listing platforms, industry-specific publications, and professional networks. Hiring a business broker can also simplify the process, as they have access to a large network of buyers and sellers, and can negotiate on your behalf.

When evaluating potential buyers, consider their financial capability, industry experience, and their long-term goals for the business. For sellers, ensure that the buyer's objectives align with preserving the company's core values and catering to existing clients or employees. Compatibility between the parties involved is vital to a smooth transition and maintaining the business's stability.

Negotiating and Closing the Deal

Once you have found a potential buyer or seller and initiated discussions, the negotiation process begins. This stage involves assessing and discussing the terms of sale, such as the purchase price, payment structure, and any contingent liabilities. It is crucial to set clear expectations and ensure that both parties are in agreement before proceeding.

Seek legal advice throughout the negotiation process to protect your interests and ensure compliance with all relevant regulations. Having a lawyer review and draft the necessary documents, such as a purchase and sale agreement, helps safeguard your rights and guarantees a smooth and legally binding transaction for both parties.

After finalizing the terms and reaching an agreement, it is time to close the deal. This involves transferring ownership, assets, and all relevant licenses or permits to the buyer. Ensure that all necessary legal requirements are fulfilled, and conduct a comprehensive handover process to ensure a seamless transition.

Buying and selling private companies and businesses can be a complex but rewarding process. By understanding the market, preparing thoroughly, finding the right buyer or seller, and navigating negotiations effectively, you can achieve a successful transaction that benefits all parties involved. Remember to seek professional advice, thoroughly research potential opportunities, and remain patient throughout the process. With the right knowledge and approach, you can confidently navigate the world of buying and selling private companies and businesses.

4.6 out of 5

| Language | : | English |

| File size | : | 2588 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 731 pages |

| Screen Reader | : | Supported |

Structured to reflect the process in practice Beswick and Wine: Buying and Selling Private Companies and Businesses focuses on the key commercial, tax and legal issues that arise from business sales. By addressing fundamental issues from the perspective of both the seller and the purchaser it is a perfect handbook for all those involved in such acquisitions.

From due diligence through to completion of the share purchase or business transfer agreement Beswick and Wine: Buying and Selling Private Companies and Businesses contains clear, expert advice.

The 10th edition has been fully revised and updated to include:

Latest Companies Act 2006 cases;

Tax changes including to entrepreneurs' relief and both corporate and personal taxes and impact on sale of share and sale of assets of a company;

Sectoral specific changes such as changes to intellectual property and competition law and impact on due diligence process including EU data protection regulation.

It also includes checklists, draft enquiries, letters of disclosure and a specimen completion agenda, together with an accompanying electronic download containing all the precedents in the work.

Howard Powell

Howard PowellUnmasking the Enigma: A Colliding World of Bartleby and...

When it comes to classic literary works,...

Jeffrey Cox

Jeffrey CoxCritical Digital Pedagogy Collection: Revolutionizing...

In today's rapidly evolving digital...

Quincy Ward

Quincy WardThe Diary Of Cruise Ship Speaker: An Unforgettable...

Embark on an incredible...

Derek Bell

Derek BellBest Rail Trails Illinois: Discover the Perfect Trails...

If you're an outdoor enthusiast looking...

Adrian Ward

Adrian WardChild Exploitation: A Historical Overview And Present...

Child exploitation is a...

Camden Mitchell

Camden MitchellThe Untold Story Of The 1909 Expedition To Find The...

Deep within the realms of legends and...

Spencer Powell

Spencer PowellThrough The Looking Glass - A Wonderland Adventure

Lewis Carroll,...

Sidney Cox

Sidney CoxAdvances In Food Producing Systems For Arid And Semiarid...

In the face of global warming and the...

Art Mitchell

Art MitchellThe Devil Chaplain: Exploring the Intriguing Duality of...

When it comes to the relationship between...

Edgar Hayes

Edgar HayesThe Mists of Time: Cassie and Mekore - Unraveling the...

Have you ever wondered what lies beyond...

John Steinbeck

John SteinbeckOn Trend: The Business of Forecasting The Future

Do you ever wonder what the future holds?...

Tim Reed

Tim ReedLove Hate Hotels Late Check Out

Have you ever experienced the joy of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gabriel MistralUnleash Your Guitar Skills with These Amazing Blues You Can Use Guitar Chords

Gabriel MistralUnleash Your Guitar Skills with These Amazing Blues You Can Use Guitar Chords

Samuel Taylor ColeridgeBible Study For The Teenage Heart: Unlocking Spiritual Growth in Today's...

Samuel Taylor ColeridgeBible Study For The Teenage Heart: Unlocking Spiritual Growth in Today's...

Arthur C. ClarkeBehind The Camera Leveled Reader Grade Infact - A Fascinating Journey into...

Arthur C. ClarkeBehind The Camera Leveled Reader Grade Infact - A Fascinating Journey into...

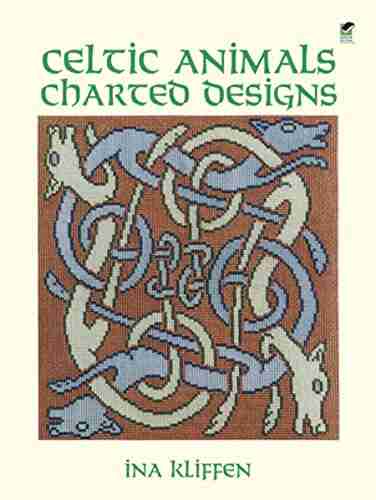

Anthony BurgessUnveiling the Enchanting Celtic Animals Charted Designs: A Needlepointer's...

Anthony BurgessUnveiling the Enchanting Celtic Animals Charted Designs: A Needlepointer's... Harvey BellFollow ·9k

Harvey BellFollow ·9k Dawson ReedFollow ·8.9k

Dawson ReedFollow ·8.9k Alfred RossFollow ·14.6k

Alfred RossFollow ·14.6k Esteban CoxFollow ·10.4k

Esteban CoxFollow ·10.4k Kevin TurnerFollow ·16.1k

Kevin TurnerFollow ·16.1k Thomas PowellFollow ·6.3k

Thomas PowellFollow ·6.3k Ervin BellFollow ·8.3k

Ervin BellFollow ·8.3k Zachary CoxFollow ·13.9k

Zachary CoxFollow ·13.9k