Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Master Market Analysis, Valuation Techniques, and Risk Management for Business Success

Market analysis, valuation techniques, and risk management are critical components of a successful business strategy. Understanding the market forces, assessing the value of assets, and effectively managing risks can dictate the longevity and profitability of a company.

Market Analysis

Market analysis involves researching and gathering information about target markets, industry trends, consumer behavior, and competition to make informed business decisions. By analyzing market data, companies can identify growth opportunities, develop effective marketing strategies, and stay ahead of the competition.

Market analysis techniques include qualitative and quantitative research methods. Qualitative research focuses on gathering insights through interviews, focus groups, and observation. Quantitative research, on the other hand, relies on data analysis and statistical modeling to identify patterns, trends, and correlations.

5 out of 5

| Language | : | English |

| File size | : | 3922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 349 pages |

By conducting thorough market analysis, businesses can gain a deeper understanding of their customers' needs, preferences, and purchasing habits. This knowledge can then be used to tailor products, services, and marketing campaigns to maximize customer satisfaction and drive sales.

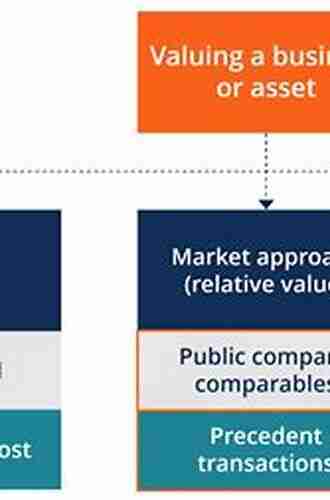

Valuation Techniques

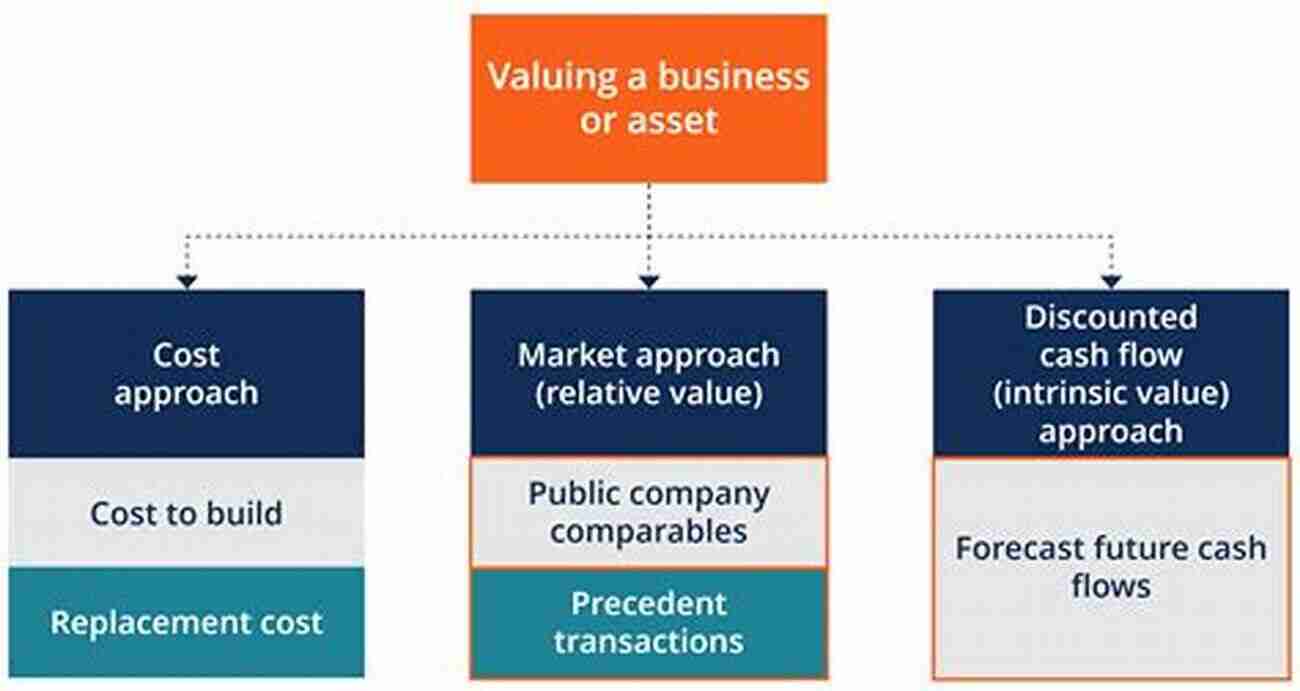

Valuation techniques are used to determine the fair value of assets, investments, and companies. Whether it's valuing a stock, a real estate property, or an entire business, accurate valuation plays a crucial role in making informed investment decisions.

There are various valuation techniques available, including discounted cash flow (DCF),price-to-earnings (P/E) ratio, comparable analysis, and asset-based valuation. Each technique has its strengths and weaknesses, and the selection depends on the nature of the asset being valued.

Valuation techniques involve analyzing financial statements, market trends, industry benchmarks, and future earnings prospects. Professional valuation analysts employ a combination of quantitative analysis, financial modeling, and industry knowledge to determine the fair value of an asset.

Accurate valuations provide insight into the investment potential, risks, and growth prospects associated with a particular asset. By understanding the true value of an investment, businesses can make well-informed decisions regarding acquisitions, divestitures, and investment portfolios.

Risk Management

Risk management involves identifying, assessing, and mitigating potential risks that could harm a business's profitability and performance. Effective risk management strategies help businesses navigate uncertain economic conditions, regulatory changes, technological disruptions, and other potential threats.

Risk management starts with a comprehensive risk assessment, which involves identifying all possible risks and evaluating their potential impact. Common risks include market risks, operational risks, financial risks, legal risks, and reputational risks.

After the risks are identified, risk management techniques such as risk avoidance, risk reduction, risk transfer, and risk acceptance are employed to minimize the negative impact. These techniques involve implementing internal controls, insurance policies, hedging strategies, and diversification.

An effective risk management strategy ensures that a business can navigate unexpected challenges and seize opportunities in a dynamic marketplace. It protects the business's assets, enhances the decision-making process, and instills confidence in stakeholders such as investors, employees, and customers.

, market analysis, valuation techniques, and risk management are vital for businesses aiming to achieve sustainable growth and success. By understanding the market forces, accurately valuing assets, and effectively managing risks, companies can make informed decisions and withstand the challenges of a competitive business environment.

5 out of 5

| Language | : | English |

| File size | : | 3922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 349 pages |

This book describes in full the major approaches used to evaluate investment in real estate and shows how theory informs decision-aid methods and tools to support such evaluation. The inclusion of numerous examples makes it also a practical guide to assessing the suitability of an investment property.

The first part of the text is devoted to an analysis of the housing market through the study of micro- and macroeconomic variables influencing supply and demand, with illustration of how these two components of the market interact. Special attention is given to market research and other preparatory activities able to influence the outcome of the investment. In fact, the quality of the parameters used for the evaluation depends on these activities. The final chapters describe the valuation techniques and highlight their essential features, limitations and potential in relation to ability to manage the investment risk.

The book is aimed at graduates who wish to deepen their study of the real estate market and of the methods used to support investment decisions in real estate but also at professionals and managers of companies operating in the real estate market.

Howard Powell

Howard PowellUnmasking the Enigma: A Colliding World of Bartleby and...

When it comes to classic literary works,...

Jeffrey Cox

Jeffrey CoxCritical Digital Pedagogy Collection: Revolutionizing...

In today's rapidly evolving digital...

Quincy Ward

Quincy WardThe Diary Of Cruise Ship Speaker: An Unforgettable...

Embark on an incredible...

Derek Bell

Derek BellBest Rail Trails Illinois: Discover the Perfect Trails...

If you're an outdoor enthusiast looking...

Adrian Ward

Adrian WardChild Exploitation: A Historical Overview And Present...

Child exploitation is a...

Camden Mitchell

Camden MitchellThe Untold Story Of The 1909 Expedition To Find The...

Deep within the realms of legends and...

Spencer Powell

Spencer PowellThrough The Looking Glass - A Wonderland Adventure

Lewis Carroll,...

Sidney Cox

Sidney CoxAdvances In Food Producing Systems For Arid And Semiarid...

In the face of global warming and the...

Art Mitchell

Art MitchellThe Devil Chaplain: Exploring the Intriguing Duality of...

When it comes to the relationship between...

Edgar Hayes

Edgar HayesThe Mists of Time: Cassie and Mekore - Unraveling the...

Have you ever wondered what lies beyond...

John Steinbeck

John SteinbeckOn Trend: The Business of Forecasting The Future

Do you ever wonder what the future holds?...

Tim Reed

Tim ReedLove Hate Hotels Late Check Out

Have you ever experienced the joy of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Griffin MitchellThe Game Of Logic Lewis Carroll: A Mind-Bending Journey into the World of...

Griffin MitchellThe Game Of Logic Lewis Carroll: A Mind-Bending Journey into the World of...

Rick NelsonInstructor Manual Mct Language Arts Curriculum Level: Your Ultimate Guide to...

Rick NelsonInstructor Manual Mct Language Arts Curriculum Level: Your Ultimate Guide to...

John UpdikeThe Ultimate San Diego City Guide 2018: Discover the Best of America's Finest...

John UpdikeThe Ultimate San Diego City Guide 2018: Discover the Best of America's Finest... Dale MitchellFollow ·17.9k

Dale MitchellFollow ·17.9k Israel BellFollow ·11k

Israel BellFollow ·11k Albert CamusFollow ·16.8k

Albert CamusFollow ·16.8k Rod WardFollow ·11k

Rod WardFollow ·11k Ralph EllisonFollow ·17.3k

Ralph EllisonFollow ·17.3k Heath PowellFollow ·2.4k

Heath PowellFollow ·2.4k Tom ClancyFollow ·10.2k

Tom ClancyFollow ·10.2k Spencer PowellFollow ·3.7k

Spencer PowellFollow ·3.7k