Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

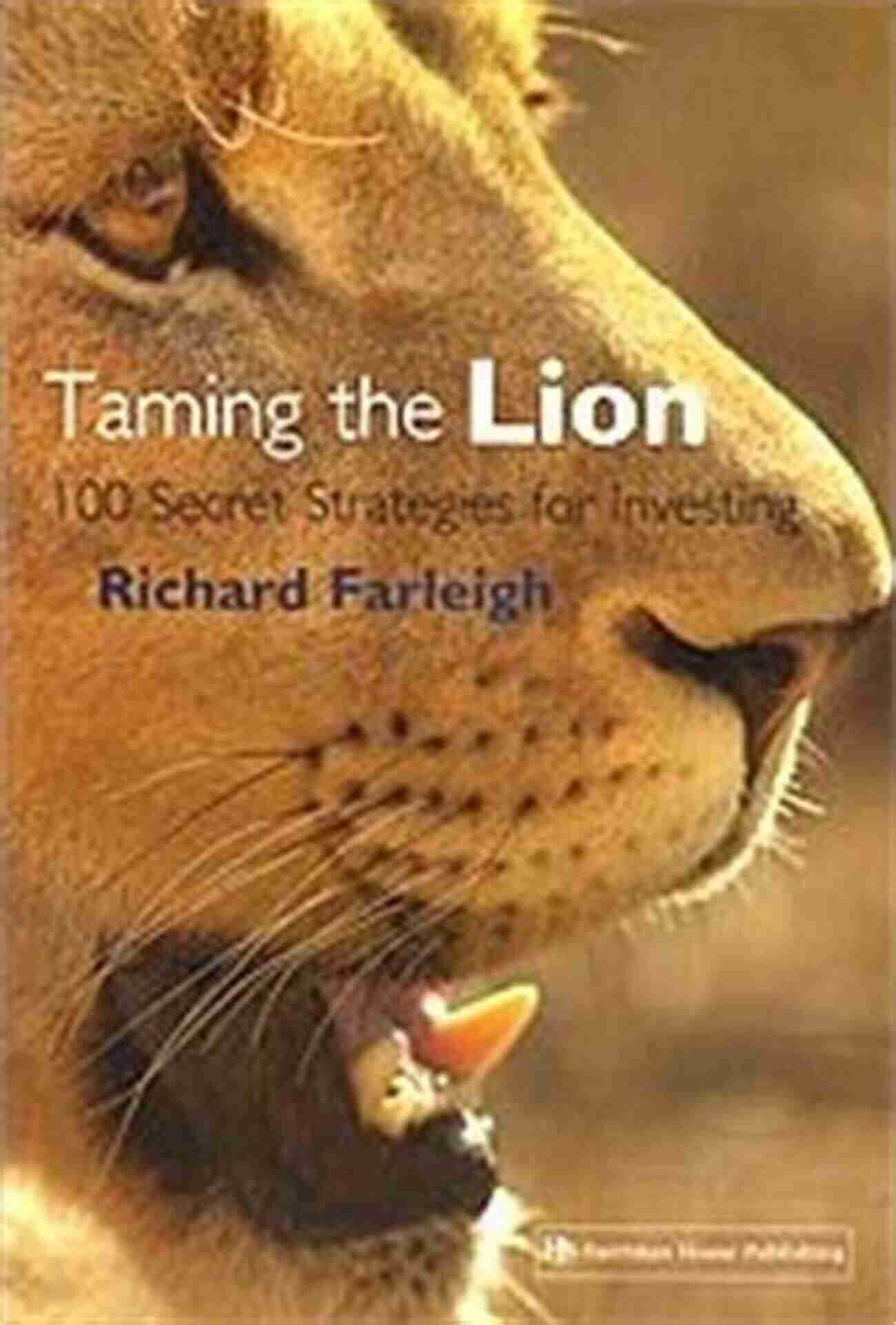

Startup Funding: Taming The Lions Of Venture Capital

Starting a business can be an exhilarating journey filled with dreams of success and financial freedom. However, for many entrepreneurs, the lack of funding can quickly squash those dreams. That's where venture capitalists come in - these financial lions prowl the business jungle, seeking out startups with potential for growth and profitability.

But how do you successfully navigate the treacherous waters of venture capital funding? In this article, we'll delve into the world of startup funding and uncover the strategies you need to tame those venture capital lions.

Understanding Venture Capital

Venture capital is a form of financing provided by investment firms or individuals to high-potential startups and small businesses. Unlike traditional bank loans, venture capital funding involves exchanging equity in the company for investment capital. This means that venture capitalists become part owners in your business and share in its success.

4.7 out of 5

| Language | : | English |

| File size | : | 1145 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 90 pages |

| Lending | : | Enabled |

While this arrangement might seem daunting, it can also be highly beneficial. Venture capitalists not only provide financial backing but also offer strategic guidance, industry connections, and mentorship to help your startup thrive.

The Hunt for Venture Capitalists

Securing venture capital funding requires identifying potential investors who align with your industry, stage of business, and growth plans. It's essential to research and target venture capital firms that have a track record of investing in startups similar to yours. Look for investors who have experience in your niche, understand your market, and can add value beyond just money.

Building relationships with venture capitalists is crucial. Attend industry events, join entrepreneur networks, and leverage your connections to reach out to potential investors. Remember, venture capitalists receive countless pitches, so it's crucial to make a compelling case for why your startup is worth their time and money.

Preparing for the Pitch

The pitch is your opportunity to showcase your startup and convince venture capitalists of its potential. Your pitch deck should be concise, visually appealing, and focused on key aspects such as market problem, solution, target audience, business model, and revenue projections.

When preparing your pitch, remember that numbers speak louder than words. Venture capitalists want to see a solid proof of concept, traction, and a clear path to profitability. Back up your claims with meaningful data and demonstrate how your startup stands out from the competition.

Negotiating the Deal

Receiving a term sheet from a venture capitalist means that they are interested in investing. This is when negotiations begin, and it's crucial to navigate this stage carefully. Understand the terms being offered, including the equity stake, board seat, investor rights, and preferred return.

Consider seeking legal counsel to ensure you fully understand the implications of the deal. Remember, it's not just about the money; the right partner can add significant value to your startup's growth trajectory.

Managing the Partnership

Once you've secured venture capital funding, it's essential to manage the partnership effectively. Regularly communicate with your investors, keeping them informed about the progress of your startup. Be transparent about challenges and seek their guidance and support when needed.

Remember, venture capitalists are not passive investors. They want to actively contribute to your success. Build a strong working relationship, leverage their expertise, and involve them in key strategic decisions.

The Journey Continues

Securing venture capital funding is an important milestone for any startup, but it's just the beginning of the journey. Use the investment wisely to execute your growth plans, achieve key milestones, and attract further funding rounds if required.

Always stay focused on your vision and keep building a product or service that customers love. The journey of a startup is filled with challenges, setbacks, and pivots, but with the right funding and support, you can tame the lions of venture capital and unleash your entrepreneurial dreams.

4.7 out of 5

| Language | : | English |

| File size | : | 1145 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 90 pages |

| Lending | : | Enabled |

Startup Funding: Taming The Lions Of Venture Capital

If you have a killer business idea, you need it backed in every way possible. Money? Direction? Experience? Yes, yes, and yes.

Venture capitalists provide you with the opportunity to acquire funding, as well as a partner who can help guide you through those tough early stages of business. Venture capital partners can show you the ropes, get you to where you need to go, and provide you with the capital you need to bring your dreams to life.

“Startup Funding: Taming the Lions of Venture Capital” will help you land that coveted deal and instill all the knowledge you need to ensure that you get the most from your partnership. From researching venture capital firms and potential partners, to preparing and practicing your presentation, you will be prepped and primed to walk into the lion’s den and tame it with ease. This book will also help you vet the offers you DO receive, to ensure you are getting the best deal possible and to assure that you are one hundred percent clear on what your deal entails.

You NEED this book. Help yourself master the art of business presentations. Land yourself an investment deal. If you are ready to land the best possible funding deal for your business, look no further. “Startup Funding: Taming The Lions of Venture Capital” has you covered.

Click the link below and follow the instructions for a FREE copy of the audio version of this book!!

https://www.audible.com/pd/B07DFSW2BK/?source_code=AUDFPWS0223189MWT-BK-ACX0-117654&ref=acx_bty_BK_ACX0_117654_rh_us

Howard Powell

Howard PowellUnmasking the Enigma: A Colliding World of Bartleby and...

When it comes to classic literary works,...

Jeffrey Cox

Jeffrey CoxCritical Digital Pedagogy Collection: Revolutionizing...

In today's rapidly evolving digital...

Quincy Ward

Quincy WardThe Diary Of Cruise Ship Speaker: An Unforgettable...

Embark on an incredible...

Derek Bell

Derek BellBest Rail Trails Illinois: Discover the Perfect Trails...

If you're an outdoor enthusiast looking...

Adrian Ward

Adrian WardChild Exploitation: A Historical Overview And Present...

Child exploitation is a...

Camden Mitchell

Camden MitchellThe Untold Story Of The 1909 Expedition To Find The...

Deep within the realms of legends and...

Spencer Powell

Spencer PowellThrough The Looking Glass - A Wonderland Adventure

Lewis Carroll,...

Sidney Cox

Sidney CoxAdvances In Food Producing Systems For Arid And Semiarid...

In the face of global warming and the...

Art Mitchell

Art MitchellThe Devil Chaplain: Exploring the Intriguing Duality of...

When it comes to the relationship between...

Edgar Hayes

Edgar HayesThe Mists of Time: Cassie and Mekore - Unraveling the...

Have you ever wondered what lies beyond...

John Steinbeck

John SteinbeckOn Trend: The Business of Forecasting The Future

Do you ever wonder what the future holds?...

Tim Reed

Tim ReedLove Hate Hotels Late Check Out

Have you ever experienced the joy of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Langston HughesUnraveling the Remarkable Life of St Rosaline The Carthusian - A True Symbol...

Langston HughesUnraveling the Remarkable Life of St Rosaline The Carthusian - A True Symbol...

Jeffrey CoxThe Secret to Controlling Singularly Perturbed Linear Time Delay Systems: A...

Jeffrey CoxThe Secret to Controlling Singularly Perturbed Linear Time Delay Systems: A... Robert HeinleinFollow ·17k

Robert HeinleinFollow ·17k Gerald BellFollow ·5.3k

Gerald BellFollow ·5.3k Elton HayesFollow ·13.8k

Elton HayesFollow ·13.8k Jamison CoxFollow ·3.6k

Jamison CoxFollow ·3.6k Vic ParkerFollow ·11.4k

Vic ParkerFollow ·11.4k Kazuo IshiguroFollow ·3k

Kazuo IshiguroFollow ·3k Everett BellFollow ·15.7k

Everett BellFollow ·15.7k Arthur MasonFollow ·19k

Arthur MasonFollow ·19k