Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

A Comprehensive Guide to Security Analysis for Investment and Corporate Finance: Unlocking the Secrets to Profitable Strategies

Investing in securities and making sound financial decisions is both an art and a science. To navigate the complex world of investments and corporate finance successfully, one must possess a thorough understanding of security analysis. In this article, we will delve deep into the realm of security analysis, exploring its importance, key concepts, and effective strategies.

to Security Analysis

Security analysis involves evaluating various financial instruments to determine their investment potential. It helps investors make informed decisions by assessing the value of securities, analyzing market trends, and forecasting future performance. This process is essential for both individual investors looking to grow their wealth and corporate finance professionals seeking opportunities for business growth and profitability.

The Importance of Security Analysis

Effective security analysis plays a pivotal role in guiding investment decisions. By conducting thorough and comprehensive analyses, investors and financial professionals can identify undervalued securities and lucrative investment opportunities. It provides a systematic and disciplined approach to investment, reducing the risks associated with speculative and impulsive decisions. Additionally, security analysis enables corporations to assess potential merger and acquisition targets, conduct due diligence, and make strategic financial decisions.

4.6 out of 5

| Language | : | English |

| File size | : | 1576 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 232 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Types of Security Analysis

There are primarily two types of security analysis: fundamental analysis and technical analysis. Let's explore each of these in detail.

Fundamental Analysis

Fundamental analysis involves evaluating a security's intrinsic value based on economic, financial, and industry data. By analyzing a company's financial statements, management quality, competitive advantage, and industry trends, fundamental analysts assess whether a security is overvalued or undervalued. This approach relies on compiling and analyzing qualitative and quantitative data to determine the true worth of a security. Fundamental analysis methods include ratio analysis, discounted cash flow analysis, and relative valuation techniques.

Technical Analysis

Technical analysis focuses on studying historical price and volume data to predict future price movements. It involves analyzing charts, patterns, and indicators to identify trends and patterns in the market. Technical analysts believe that all relevant information about a security is reflected in its price and volume. They utilize various tools and techniques, such as moving averages, support and resistance levels, and trend lines, to make predictions and guide investment decisions.

Approaches to Security Analysis

When conducting security analysis, investors and financial professionals can adopt different approaches based on their risk appetite and investment goals. Let's explore some of the widely used approaches:

Value Investing

Value investing, popularized by renowned investor Warren Buffett, involves identifying undervalued securities and investing in them for the long term. Value investors believe that the market occasionally undervalues certain stocks or securities, presenting buying opportunities. They analyze a company's fundamental factors, such as its earnings, assets, and management quality, to determine its intrinsic value. By buying stocks below their intrinsic value, value investors aim to generate significant returns over time.

Growth Investing

Growth investing focuses on identifying and investing in companies that have robust growth potential. This approach involves analyzing a company's future earnings growth, expansion plans, and market positioning. Growth investors prioritize companies with innovative products or services, strong competitive advantages, and the potential to disrupt industries. They aim to capitalize on the appreciation of stock prices as these companies experience rapid growth.

Income Investing

Income investing involves seeking securities that generate consistent income, such as bonds, dividend-paying stocks, or real estate investment trusts (REITs). Income investors look for securities that offer attractive yields and stable income streams. They prioritize security and regular cash flow over significant capital appreciation. This approach is often favored by risk-averse investors seeking stable and predictable returns.

Strategies for Effective Security Analysis

Now that we have explored the fundamentals of security analysis, let's delve into some strategies to make your security analysis more effective:

Diversify Your Portfolio

One of the most crucial strategies for successful security analysis is portfolio diversification. By investing in a wide range of securities across different sectors, industries, and asset classes, you can spread your risk and minimize the impact of any single security's poor performance. Diversification helps protect your portfolio from extreme losses and allows you to capture potential gains from different sectors.

Stay Informed and Analyze Market Trends

Staying up-to-date with the latest market trends and news is essential for effective security analysis. Analyze economic indicators, industry reports, and company-specific news to identify emerging trends, potential opportunities, and risks. Continuous learning and monitoring of market conditions will enable you to make well-informed investment decisions.

Utilize Advanced Analytical Tools

In today's digital age, advanced analytical tools and software can significantly enhance the accuracy and efficiency of your security analysis. leverage These tools can leverage big data, machine learning algorithms, and artificial intelligence to process vast amounts of information and provide valuable insights. Whether it is financial modeling software, stock screeners, or technical analysis platforms, using these tools can give you a competitive edge in the complex world of investing and corporate finance.

Security analysis is a fundamental aspect of investment and corporate finance. By thoroughly evaluating securities, understanding market trends, and adopting effective strategies, investors and financial professionals can unlock profitable opportunities and mitigate risks. Whether you are an individual investor seeking financial growth or a corporate finance professional making strategic decisions, security analysis is a powerful tool that can guide you towards success. Embrace the art and science of security analysis, and unlock the secrets to profitable strategies.

4.6 out of 5

| Language | : | English |

| File size | : | 1576 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 232 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Damondaran on Valuation will not only convince you of the vitalityof the many valuation models available to you, it will help ensurethat you develop the acumen needed to select the right model forany valuation scenario.

Written by a gifted teacher and respected valuation authority, Damodaran on Valuation offers systematic examination of the threebasic approaches to valuation - discounted cash-flow valuation,relative valuation, and contingent claim valuation - and thevarious models within these broad categories.

Using numerous real-world examples involving both US andInternational firms, the book illuminates the purpose of eachparticular model, its advantages and limitatations, thestep-by-step process involved in putting the model to work, and thekinds of firms to which it is best applied. Among the toolspresented are designed to:

- Estimate the cost of equity - including the capital asset pricingmodel and arbitrage pricing model

- Estimate growth rates - with coverage of how to arrive at aweighted average of growth rates by blending three separateapproaches

- Value equity - focusing on the Gordon Growth Model and thetwo-and three-stage dividend discount model

- Measure free cash flow to equity - cash flows that are carefullydelineated from the dividends of most firms

- Value firms - including free cash flow to firm models, which areespecially suited to highly leveraged firms

- Estimate the value of assets by looking at the pricing ofcomparable assets - with insight into the use and misuse ofprice/earning and price/book value ratios, and underutilizedprice-to-sales ratios

- Measure the value of assets that share option characteristics -including a comparative look at the classic Black-Scholes andsimpler binomial models

Supported by an optional IBM-compatible disk, which consists ofspreadsheet programs designed to help users apply the modelshighlighted in the book, Damodaran on Valuation providespractitioners involved in securities analysis, portfoliomanagement, M&A, and corporate finance with the knowledge theyneed to value any asset.

Howard Powell

Howard PowellUnmasking the Enigma: A Colliding World of Bartleby and...

When it comes to classic literary works,...

Jeffrey Cox

Jeffrey CoxCritical Digital Pedagogy Collection: Revolutionizing...

In today's rapidly evolving digital...

Quincy Ward

Quincy WardThe Diary Of Cruise Ship Speaker: An Unforgettable...

Embark on an incredible...

Derek Bell

Derek BellBest Rail Trails Illinois: Discover the Perfect Trails...

If you're an outdoor enthusiast looking...

Adrian Ward

Adrian WardChild Exploitation: A Historical Overview And Present...

Child exploitation is a...

Camden Mitchell

Camden MitchellThe Untold Story Of The 1909 Expedition To Find The...

Deep within the realms of legends and...

Spencer Powell

Spencer PowellThrough The Looking Glass - A Wonderland Adventure

Lewis Carroll,...

Sidney Cox

Sidney CoxAdvances In Food Producing Systems For Arid And Semiarid...

In the face of global warming and the...

Art Mitchell

Art MitchellThe Devil Chaplain: Exploring the Intriguing Duality of...

When it comes to the relationship between...

Edgar Hayes

Edgar HayesThe Mists of Time: Cassie and Mekore - Unraveling the...

Have you ever wondered what lies beyond...

John Steinbeck

John SteinbeckOn Trend: The Business of Forecasting The Future

Do you ever wonder what the future holds?...

Tim Reed

Tim ReedLove Hate Hotels Late Check Out

Have you ever experienced the joy of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Troy SimmonsDalmatian Dog Characteristics, Personality, Temperament, Diet, Health, and...

Troy SimmonsDalmatian Dog Characteristics, Personality, Temperament, Diet, Health, and...

Colton CarterThe Enigmatic Natural History Of Unicorns: Legends, Myths, and the Pursuit of...

Colton CarterThe Enigmatic Natural History Of Unicorns: Legends, Myths, and the Pursuit of...

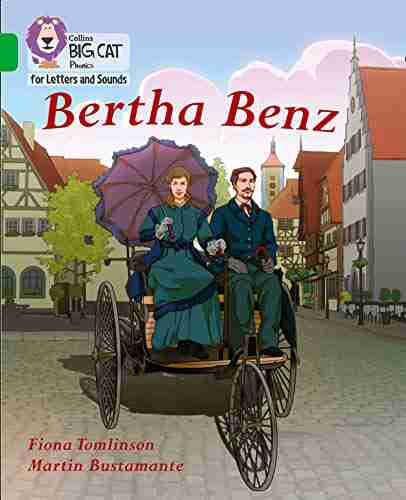

Theodore MitchellUnleash the Power of Phonics: Collins Big Cat Phonics For Letters And Sounds...

Theodore MitchellUnleash the Power of Phonics: Collins Big Cat Phonics For Letters And Sounds... Peter CarterFollow ·8.2k

Peter CarterFollow ·8.2k Joseph ConradFollow ·6.6k

Joseph ConradFollow ·6.6k Max TurnerFollow ·14.4k

Max TurnerFollow ·14.4k Abe MitchellFollow ·17.8k

Abe MitchellFollow ·17.8k Henry JamesFollow ·4.5k

Henry JamesFollow ·4.5k Alfred RossFollow ·14.6k

Alfred RossFollow ·14.6k Emilio CoxFollow ·8k

Emilio CoxFollow ·8k Isaiah PowellFollow ·19.7k

Isaiah PowellFollow ·19.7k